Market Research For Restaurants: Four Steps To Understand Your Customers And Stay Competitive

In this article, we are going to show you step-by-step how to do marketing research for your restaurant so you can make informed decisions to improve your restaurant.

Market research is the process of gathering information about your customers, your competitors, and the demand in your area.

As a restaurant owner, that can mean understanding who’s actually ordering from you, what people in your local area are searching for online, or how nearby competitors are pricing and positioning their restaurants.

Operators use this kind of information to answer practical questions, like:

Is there enough demand for a new menu item?

Are your prices in line with the current market?

Are you attracting the right customer—or missing something entirely?

Market research gives you the facts you need to adjust, improve, or grow with more accuracy and less guesswork.

In this article, you will learn:

- How to define and understand your ideal target market

- What to look for when analyzing your competitors and your neighborhood

- Ways to apply market research insights to your menu, pricing, and marketing

Step One: Pinpoint Who You’re Trying To Reach

Restaurant market research begins with understanding your target market—the people most likely to choose your restaurant over others in your area.

Start With Your Ideal Guest

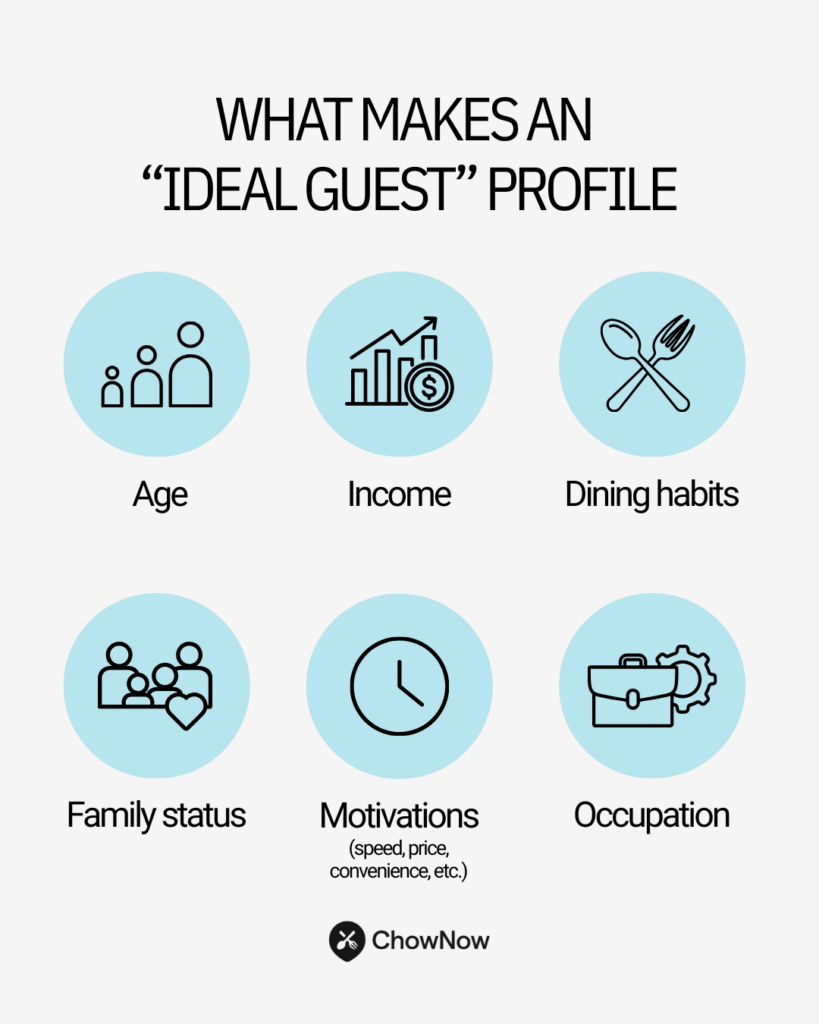

Before you can make smart decisions about your menu, pricing, or promotions, you need a clear picture of who you’re serving.

Every restaurant has a mix of guests, but your target market should be the group you most want to reach—the people who naturally love what you offer and are most likely to become repeat customers.

Start by identifying the traits that define your ideal guest. Think about their:

- Age range

- Income level

- Dining habits

- Occupation

- Family status

Also, consider what motivates your ideal customer to go out to eat—what do they care about most?

Is it service speed, atmosphere, convenience, price, or health options that matter most?

Are you trying to reach families, office workers, commuters, or younger customers looking for something quick and social?

These details shape everything from your menu to your branding.

Use Data From Your Own Restaurant

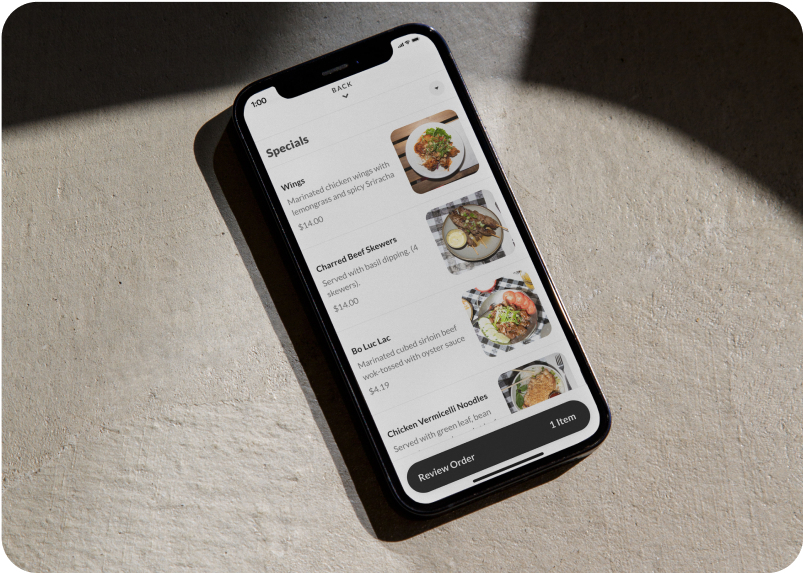

Your POS and online ordering system are packed with valuable customer insights.

Pull diner data from each of these and study order frequency, which dishes sell the most, peak business times, repeat customers, and average ticket sizes.

You should also pay close attention to customer interactions, whether in person or online, and regularly check review platforms (Google, Yelp, Facebook, etc.) for patterns in customer feedback.

These insights reveal what your customer base values, and what may be turning them off.

Start asking Your Customers the Right Questions

To dig deeper, consider using surveys, comment cards, and basic survey tools to gather demographic or behavioral details.

Even simple questions like:

- “What brings you in today?”

- “What would you love to see on the menu?”

—can surface useful consumer preferences. These tactics are low-cost and can deliver high-value market research insights.

Take What You’ve Learned and Put It Into Action

Once you’ve gathered enough research, start applying it. Use your findings to refine your menu, adjust pricing, and focus your promotions.

When you align your restaurant business decisions with real customer insights, you don’t just attract customers—you build loyalty and long-term customer satisfaction.

Step Two: Study Your Competition And Spot Your Opportunity

Understanding the competition is one of the smartest forms of market research you can do. Knowing how other restaurants in your area operate helps you see what’s working, what isn’t, and where there’s room for your restaurant to stand out.

Identify Your Real Competitors

Start by mapping out both direct and indirect competitors. Your direct competitors are the ones serving a similar type of food at a similar price point, while indirect ones might offer different cuisines but compete for the same diners’ time and money.

For example, a local burger spot might compete with a taco shop down the street if they both draw the same lunchtime crowd. The goal is to understand the full restaurant market you’re part of—not just the places that look like yours.

Analyze Their Strengths and Weaknesses

Once you’ve identified your competition, it’s time to analyze how they position themselves. Review their menu items, pricing, branding, and digital presence.

Look closely at customer reviews and social media to see what people praise or complain about most. If diners are consistently calling out long waits, confusing online menus, or limited options, that’s your chance to offer a better dining experience or faster service speed.

Fill Competitive Gaps to Your Advantage

The most effective restaurant market analysis turns weaknesses into opportunities. If a nearby spot has great food but poor online ordering, lean into that by making your takeout process seamless and user-friendly.

Or if your competitors offer similar dishes, experiment with menu innovation or a new flavor twist that gets people talking.

Paying close attention to details can reveal opportunities to differentiate your brand and gain a real competitive edge.

Turn Your Competitor Insights Into Action

Restaurant market analysis isn’t just a one-time exercise—it’s an ongoing process.

Regularly revisit what other restaurants are doing so you can stay ahead of industry trends. As your neighborhood evolves and customer preferences shift, continuous observation ensures you’re not playing catch-up.

The more consistently you track your competition, the easier it becomes to adjust your menu, pricing, and marketing to stay relevant and profitable.

Step Three: Validate Demand In Your Neighborhood

Now that you know exactly who your target customers are and understand your competition, the next step in restaurant market analysis is confirming there’s a real demand for what you offer.

Even the best concept can struggle if it’s not matched to the needs and preferences of your local community.

Study Who Lives, Works, and Dines Near You

Start with your local market basics: who’s in your neighborhood?

Look at census data, city planning tools, and platforms like Placer.ai or Spatial.ai to gain insight into demographics, commuting patterns, and how much foot traffic different blocks get at various times.

If you’re a dine-in concept but your area is full of potential customers who just want to grab something on the go, that mismatch will hurt your sales.

Your delivery zone matters too. Look at your online ordering data:

- Where are people ordering from?

- What are they ordering?

- How often?

These are signals of real-world consumer preferences, and they tell you whether your current approach is a fit for the surrounding restaurant market.

Use Surveys and Ask Your Community for Feedback

Surveys, whether online or in-person, are one of the most underrated forms of qualitative research.

Ask your regulars what they think of your menu, price point, hours, and experience.

Ask non-customers (friends, neighbors, locals) what would make them more likely to stop by. Comment cards still work too, especially if you include a small reward like a discount if they visit soon.

You’re not just collecting feedback—you’re conducting market research that helps you bridge the gap between what you’re offering and what people actually want.

Check If Your Offer Matches Local Demand

Now ask the big question: Does your menu, pricing, and dining experience actually align with what people in your area are looking for?

Are you too expensive for the area?

Too formal?

Offering flavors that don’t resonate with the local crowd?

For example, if you discover that nearby diners prefer healthy fast-casual meals, but your focus is rich comfort food, you might consider adding lighter options or smaller portions for greater customer satisfaction.

The more you align your food service with proven customer preferences, the higher your chances of earning repeat visits, growing sales, and creating long-term success in your neighborhood.

Step Four: Use Research To Guide Menu, Pricing, And Marketing Decisions

Once you’ve gathered solid insights from your market research, it’s time to put them to work. The goal is to turn what you’ve learned into action so you can make more money and improve the customer experience.

Use Market Research to Spot Menu Trends and Diner Preferences

Your restaurant market analysis can reveal patterns you might miss day to day, like which menu items perform best, what dining experience guests expect, and which customer preferences are growing in popularity.

For example, nearly 75% of all restaurant traffic now happens off-premises, meaning more diners are choosing takeout or delivery instead of eating in.

You can use data like this to guide menu innovation, plan around seasonal shifts, and identify new opportunities.

For instance, if your research shows a spike in plant-based demand or younger customers looking for bolder flavors from abroad, consider introducing limited-time options that tap into those trends.

Leverage Data to Refine Pricing and Item Placement

Your market analysis shouldn’t stop at the menu. By tracking social media performance, reading online reviews, and reviewing your online ordering reports, you can uncover how customers perceive value.

Maybe a fan-favorite dish underperforms because it’s priced too high, or perhaps it just needs to be paired with another item to make it an easy choice for guests.

Using data from reviews and order reports helps you make informed pricing adjustments and optimize the placement of items on your menu, both online and in-store, to attract more attention and encourage customers to try high-margin dishes.

Test and Measure Before Fully Committing

Not every new idea needs to roll out systemwide right away. Smart restaurant owners test small, then scale what works.

Use limited-time offers (LTOs) to experiment with new menu concepts, pricing strategies, or promotions.

Track customer interactions and sales to see what resonates most before investing fully. This approach combines quantitative research with real-world results, helping you stay agile, minimize waste, and keep your restaurant aligned with what your customers actually want.

EMBED: https://www.instagram.com/p/DQZgW3IlO42/

Let Market Research Guide Your Restaurant’s Next Move

Smart market research for restaurants turns information into direction. By grounding your decisions in real data and customer insights, your restaurant can adapt faster and stay ahead of shifting diner preferences.

Contact ChowNow to learn how a Direct Online Ordering system can turn your market insights into higher sales, without third-party fees cutting into your profits.

Market Research for Restaurants Frequently Asked Questions

What is market research for restaurants?

Market research for restaurants is the process of collecting and analyzing data about your customers, competitors, and the overall restaurant market to make better business decisions.

It helps restaurant owners understand what drives customer satisfaction, how menu items perform, and where opportunities exist to attract more diners or improve profits.

How do you conduct market research for a restaurant?

To conduct market research, start by defining your target market and studying your competition. Use a mix of quantitative research (like online ordering reports, POS data, and sales trends) and qualitative research (like customer feedback, surveys, and focus groups) to identify patterns.

Combine these insights with neighborhood and demographic data to guide your menu, pricing, and marketing strategies.

Why is market research important for restaurants?

Market research is essential because it helps restaurant owners make informed decisions based on facts rather than assumptions. It reveals how customers behave, what they value, and how industry trends, like off-premises dining, affect demand.

When you use market analysis to shape your strategy, you can lower risks, improve customer experience, and maintain a strong competitive edge in your local market.

How do I identify my restaurant’s target market?

To find your target market, start with the data you already have, like loyalty program activity, online ordering reports, and POS customer data. Then, look at demographics (age, income, location) and psychographics (motives, dining habits, and preferences).

The goal is to identify who your best customers are and what drives their dining decisions so you can focus your menu, marketing, and pricing around their needs.

What tools can restaurants use to track customer behavior?

Restaurants can use POS systems, loyalty programs, and online ordering platforms to track customer interactions and identify trends. Review analytics from Google Business, social media, and delivery platforms to understand what’s resonating. Survey tools like Google Forms or Typeform help collect direct customer feedback, while dashboards and reporting tools turn that information into actionable insights that improve your restaurant business.