Why Restaurant Customer Acquisition Cost Matters And How To Improve It

In this article, we are breaking down why restaurant customer acquisition cost matters to your business and the steps you can take to improve it.

Customer acquisition cost (CAC) measures how much money you spend on—ads, discounts, promotions, emails, loyalty program signup rewards, and more—to attract one new customer.

Knowing your customer acquisition cost means you can see what’s working, what’s wasting money, and where to shift your marketing budget.

If Instagram ads cost $12 per new diner, but a collaboration with an influencer brings in a new customer for only $3, you instantly know where to invest.

Restaurant CAC gives you the clarity you need to determine whether your marketing efforts are creating revenue or just draining time and resources.

In this article, you will learn:

- How to calculate your restaurant’s customer acquisition cost

- What a good customer acquisition cost looks like across different service types

- How to lower CAC using proven, profit-focused strategies

How To Calculate Customer Acquisition Cost

Figuring out your customer acquisition cost isn’t complicated; you just need the right inputs and a simple formula.

Calculating it once will give you a solid baseline to start tracking monthly and then using the data to make smarter decisions with your marketing resources. Most operators realize fairly quickly that CAC reveals which marketing channels deserve more investment, and which ones can be cut out entirely.

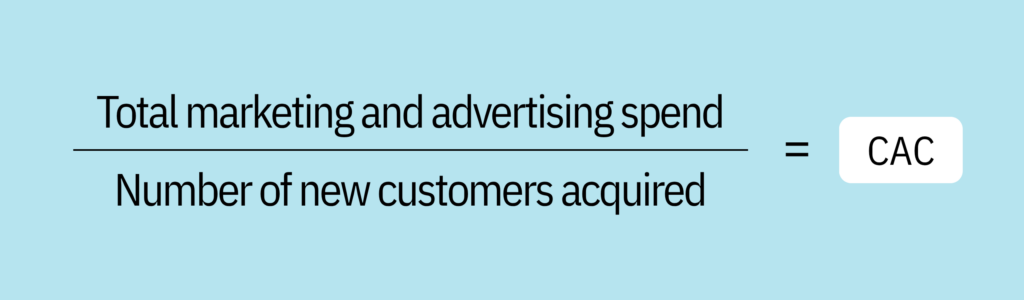

The Formula for Calculating Customer Acquisition Cost

Every restaurant operator should know this simple customer acquisition cost formula:

CAC = Total marketing and advertising spend ÷ Number of new customers acquired

Let’s say last month, you spent:

- $1,200 on Instagram ads

- $400 offering a first-order discount

- $400 to hire a freelance marketer

That’s a total marketing expense of $2,000. If those efforts brought in 100 new customers, your CAC would look like this:

$2,000 ÷ 100 = $20 CAC

That means you spent $20 to acquire each new customer.

How often you calculate your restaurant’s customer acquisition cost (most operators do it monthly or quarterly) entirely depends on how often you’re running campaigns and promotions.

What Costs Should You Include When Adding Up Your CAC?

This is where many restaurant owners make mistakes because they undercount what should be included in the customer acquisition cost total.

You need to include every cost tied to acquiring customers, not just the obvious ones, because CAC should reflect the true cost of attracting a new customer.

Include costs like:

- Paid digital ads: Facebook, Instagram, Google Ads, or other social media ads promoting your restaurant

- Discounts and promotions: Deals like first-order discounts or limited-time offers to bring in new customers

- Creative production: Photography, video, or branded content created for specific campaigns

- Freelancers or agencies: If you hired outside help for marketing execution or design

- Print materials: Flyers, direct mail, or local paid advertising targeting new audiences

If you spent money with the intention of acquiring new customers, it belongs in your CAC calculation.

Just as important, though, is what NOT to include, like anything that’s tied to serving existing customers, retention programs, or general operating costs. CAC is strictly about acquiring new customers, not keeping them.

Now that you know how to calculate your CAC, the next question is: how do you know if that number is good or bad?

Understanding What Makes a Good Customer Acquisition Cost

A “good” restaurant customer acquisition cost depends on your concept, location, and the marketing channels you use to reach new customers.

What matters most is that your CAC is lower than the profit the customer generates over time. If CAC is too high, you’re losing money to gain new customers, even if sales look good on paper.

Typical CAC Ranges for Restaurants

There’s no “one-size-fits-all” CAC average, but these are based on a current industry report:

- QSR/Fast Food: $27

- Fast Casual: $83

- Casual Dining: $125

- Fine Dining: $180

If these numbers seem higher than what you’d normally expect, it’s because this study focuses only on net new customers. Often, when operators run marketing campaigns, ads generate clicks and orders from existing customers, which artificially lowers the average CAC. This data isolates the cost of bringing in a customer who has never ordered before.

Your customer acquisition cost can also change dramatically based on what marketing channel you use for your customer acquisition efforts. For example, these are the average CAC for online ads:

The truth is, a high CAC isn’t inherently bad, just so long as your new customer spends more money than it costs to acquire them— that’s what customer lifetime value (CLV) helps you measure.

What is Customer Lifetime Value and How Does It Compare To CAC

Before you can determine if your customer acquisition cost is “good,” you need to compare it to your customer lifetime value (CLV).

Your customer lifetime value measures how much revenue a customer generates for your restaurant over the course of their relationship with your business.

CAC Shows the Costs, While CLV Shows the Return

Many operators focus on lowering CAC, thinking that cheaper is better, and they’re not wrong, but by itself, CAC can be misleading.

Some customers order once and never return. Others become regulars and come back dozens of times a year. CLV helps you quantify that difference.

Here’s why CAC only matters in the context of CLV:

If you know what a customer is worth long-term, you can afford to spend more to acquire them up front.

Think of it this way…

Without CLV, CAC is just a cost—with CLV, CAC becomes an investment.

How to Calculate Your Customer Lifetime Value

You can calculate your CLV using three KPIs you likely already know:

- Average Order Value

- Purchase Frequency (how often they place an order)

- Customer Lifespan

The formula looks like this:

CLV = Average Order Value × Purchase Frequency × Customer Lifespan

Here’s a simple example using a fictional restaurant.

Let’s say your:

- Average order value is $25

- Customer orders 2 times per month (12 per year)

- Average guest stays loyal for 2 years

$25 x 12 x 2 = $ 600 CLV

Knowing your average customer is worth roughly $600, your CAC suddenly has context, and spending $40-$50 to acquire them becomes a smart investment, and not a cost to minimize.

A restaurant’s customer lifetime value isn’t always as profitable as this example, though, which is why it’s important to always check your CAC against your CLV.

When CLV is greater than CAC:

- You can confidently invest in marketing because you know you’ll earn it back

- You attract customers who stick around instead of one-and-done coupon chasers

- You build predictable, repeatable revenue

But when CAC is higher than CLV, the math is working against you. You’re paying more to bring customers in than they spend with you over time.

Let’s look at strategies that can help you keep your CAC in check.

Strategies To Lower Restaurant CAC

Even if your CLV looks amazing, like in our example above, where it only costs $50 to bring in a customer with a lifetime value of $600, there’s always room for improvement.

These strategies focus on leveraging the tools you already own, keeping customers who already love you coming back, and spending your marketing dollars efficiently.

Strengthen Your First-Party Channels

First-party channels are your lowest-CAC acquisition engines because there’s no middleman and no commission per order. The more guests you push into channels you own, the less you pay to reach them again.

Ways to improve first-party acquisition:

- Make your website ordering prominent (large “Order Now” button, above the fold)

- Offer a first-order incentive that drives customers to your direct ordering system instead of third-party apps

When a customer orders directly from you, you keep the revenue, the customer data, and the relationship.

Focus on Retention — It’s Cheaper Than Acquisition

Acquiring new customers is expensive. Encouraging repeat business is the fastest and most affordable way to lower your customer acquisition costs.

Use retention tools that turn first-time diners into regulars, like:

- Loyalty programs with meaningful rewards

- Automated email with timely offers

Instead of constantly paying to acquire brand-new guests, build a system that gets more value out of the ones you already have—every repeat order lowers your effective CAC.

Put Ad Spend Where It Works (Cut What Doesn’t)

Most customer acquisition cost problems are caused by one thing: spending money without tracking performance.

Use these best practices to ensure you’re getting the most out of your marketing budget:

- Set up tracking links for each channel (Google Ads vs. Meta vs. Yelp)

- Evaluate ads weekly: cost per click, cost per conversion, number of new customers

- Adjust or eliminate campaigns that aren’t bringing in new customers

Reinvest your money into what’s working and pull back from anything that’s not driving profitable growth.

Turn Customer Acquisition From a Cost Into a Growth Engine

When you know your CAC and invest in the channels that bring in profitable customers, every marketing dollar has a purpose. Track it, refine it, and use the data to grow with confidence.

Contact ChowNow to learn how Automated Email Marketing and a Rewards Program can help you lower your customer acquisition cost by turning first-time guests into repeat direct orders.

Restaurant Customer Acquisition Cost Frequently Asked Questions

What is customer acquisition cost for restaurants?

Customer acquisition cost (CAC) is how much your restaurant spends to bring in one brand-new customer. It includes the money you invest in marketing activities that are designed to reach people who have never ordered from you before—things like paid ads, first-order incentives, or email marketing tools.

How do you calculate restaurant customer acquisition cost?

Use this formula:

CAC = Total marketing spend ÷ Number of new customers acquired

Choose a time period—usually a month or quarter—add up what you spent on marketing during that time, then divide it by the number of new customers those efforts brought in. For example, if you spent $500 on marketing in a month and gained 50 new customers, your CAC is $10.

What is a good customer acquisition cost for a restaurant?

There isn’t one “perfect” CAC number because every restaurant is different. What matters is that your CAC is lower than the profit you make from that customer over time. If you spend $10 to acquire a customer who ends up spending $200 over multiple visits, that’s a strong CAC. If you spend $40 to get someone who only orders once and spends $18, that’s not sustainable.

Should CAC include discounts or promotions?

Yes—if the promotion was used to attract a new customer. A first-order discount, referral incentive, or promo code counts toward CAC because it’s money spent to acquire someone who hasn’t ordered before. If the promo is used to bring back someone who’s already a customer, that falls under retention—not acquisition.

How often should restaurants review their CAC?

Monthly is the sweet spot. Reviewing CAC once a month gives you enough data to see trends and know which channels are bringing in new customers efficiently, and which ones are wasting money. The more you measure, the faster you can redirect your marketing dollars toward what’s actually working.