Restaurant Operating Costs Breakdown: The Comprehensive Guide Every Operator Should Know

In this guide, we’re going to break down restaurant operating costs so you can understand exactly where your money is going each month and how you can manage it more effectively.

Your operating costs are the ongoing expenses required to keep the business running. That includes food costs, labor costs, rent, utilities, tech, marketing, and more.

When restaurant operating costs aren’t clear, it becomes difficult to set profitable menu prices, protect your margins, or find opportunities to save money.

Understanding operating costs gives you the control you need to make smarter decisions—like how to adjust purchasing when fluctuating food prices impact which ingredients you can buy, or choosing where to reduce spending between your fixed costs and variable costs.

Clear visibility into restaurant expenses also allows you to forecast cash flow and avoid surprises.

In this article, you will learn:

- The key differences between operating costs, startup costs, and prime costs

- A breakdown of major restaurant cost categories and how to manage each one

- Smart strategies for controlling costs without sacrificing customer service

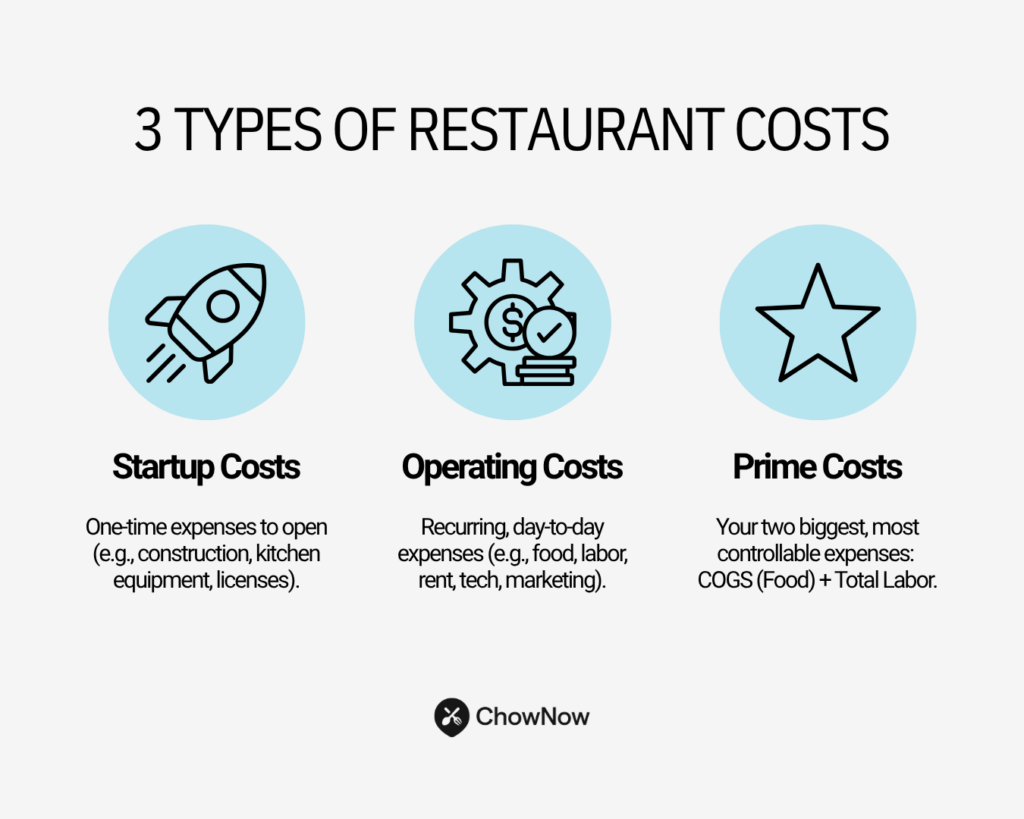

Operating Costs vs. Startup Costs vs. Prime Costs

Before we dive into the numbers, it helps to understand the different types of costs restaurants contend with and which ones you can actually control to improve your margins.

We’ll start by breaking them into three major categories.

What are Operating Costs in your restaurant

These are your day-to-day operating costs, for example:

- Food costs

- Labor costs

- Rent

- Utilities costs

- Software/technology tools

- Marketing

- Maintenance

Think of these as your recurring restaurant expenses that show up every month. Because they make up the bulk of your expenses, understanding them helps you control costs and make better decisions based on your restaurant’s total revenue rather than gut instinct.

What are Startup Costs, and how are they different

Restaurant startup costs are one-time expenses you pay when opening or significantly expanding your restaurant. This might include:

- Construction costs

- Kitchen equipment costs

- Business registration fees

- Licensing costs

- Renovation costs

Unlike ongoing operating costs, restaurant startup costs only happen once, so when your business is up and running, it’s something you no longer have to factor into your daily operating expenses.

Confusing the two can throw budgets off balance, making it essential to distinguish between one-time and repeat expenses.

What is Prime Cost and why it deserves your attention

Your prime cost is the combination of your two largest expenses.

- COGS (cost of goods sold)

- Total labor costs

Together, they make up the biggest portion of your monthly spending, and they are also the most controllable.

Because of this, most restaurants track prime cost weekly, or even daily, because having the ability to adjust portioning, food inventory, scheduling, and hourly wages even a small amount, can have a major impact on profits.

Restaurant owners who actively monitor prime cost stay ahead of rising restaurant labor costs, minimum wage rates, and fluctuating food prices, giving them more control over their margins. We’ll go into more details about prime cost in a minute.

Now, let’s break down the main categories of ongoing restaurant operating costs and how to manage them strategically.

Cost Category Breakdown: Where Restaurants Spend the Most

Every restaurant has unique challenges, but most spending falls into five core categories. Understanding where your money goes and how each cost behaves is key to better cost management and healthier margins.

Food + Beverage Costs (COGS)

Food costs and beverage costs, also known as COGS (cost of goods sold), encompass everything you need to produce your menu items, including: ingredients, alcohol, condiments, paper goods, and to-go packaging.

These are direct costs tied to the food and drinks you sell. If you don’t manage ordering and waste, your food cost percentage climbs fast.

Things that influence your total restaurant food costs include:

- Spoilage, theft, or over-ordering (in the restaurant industry, this is called shrinkage)

- Fluctuating market prices from suppliers

- Poor portioning or inconsistent recipes (higher plate cost)

Most restaurants aim for a food cost percentage of 30% to 40%, but what this number is exactly depends heavily on your restaurant’s concept, volume, and location. Fast-casual might hit the low end; fine dining establishments tend to land higher due to premium ingredients.

Mastering inventory and portion control allows you to save money without lowering the quality of your menu—a necessary part of reducing food costs.

Labor Costs

Labor costs include hourly wages, salaried employees, training, payroll taxes, and employee benefits. Restaurant labor costs are often the largest expense besides food, and they can fluctuate based on demand and staffing levels.

Because labor costs have a mix of both fixed and variable components, your total labor costs can vary widely if scheduling isn’t tight.

The goal to save money isn’t just to cut hours—it’s to schedule based on demand and maintain employee retention through proper training, so you’re not constantly hiring new hourly workers.

Many restaurants aim for a labor cost percentage of 20% to 30%, although this can fluctuate based on factors such as your service model, turnover rate, or minimum hourly employee wage rates in your area.

Overhead/Occupancy Costs

These are your fixed costs, which include:

- Rent or lease

- Utility costs

- Repairs

- Trash and pest control

- Equipment maintenance and kitchen equipment costs

- Insurance premiums and property taxes

Because these costs don’t fluctuate with your sales volume, the goal isn’t necessarily to cut them—it’s to make sure sales are high enough that overhead remains manageable.

Still, over time, you can explore energy-saving appliances, negotiate lease terms, or better maintain kitchen equipment to reduce long-term overhead.

The average overhead rate for most restaurants is typically between 15% to 25%—if you find you’re spending it outside of this range, look for strategies that help reduce operating expenses.

Marketing and Advertising

Marketing costs can be both fixed and variable costs, depending on your strategy. This includes channels like:

- Google ads or digital ads

- Loyalty programs

- Automated emails

- Local influencer collaborations

- Social media campaigns

- Restaurant websites

The most successful operators spend efficiently, not more, meaning they invest in channels that bring in high-value, repeat customers. It’s significantly more cost-effective to bring in repeat customers than to try to attract new diners every day.

While budgets can vary, most restaurants budget around 3% to 6% of revenue on marketing. Tools that improve guest retention (like automated emails or rewards apps) often provide the best ROI.

Technology and Software Costs

Modern restaurants rely on tools that streamline operations:

- POS and restaurant management systems

- Direct online ordering

- Scheduling and payroll tools

- Inventory and recipe costing platforms

These tools fall under semi-variable costs—meaning, they’re recurring but can scale up or down depending on your setup. While these appear as additional operating expenses, it’s good to think of this category as an investment.

The right tech stack can reduce labor inefficiencies, minimize errors, and help you save money in areas like order accuracy, staffing, and automating tasks.

Now that we know the five major costs every restaurant has to manage, let’s look at how you can calculate your operating expenses.

How To Calculate Your Operating Costs

Once you understand where your money is going, the next step is calculating your total operating costs. Doing this gives you a clear picture of how much money your business needs to pull in to keep your restaurant running each month.

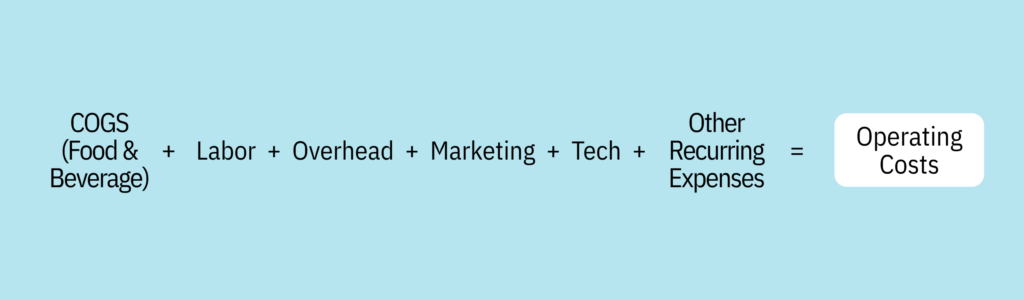

Operating Costs Formula

Fortunately, calculating your operating costs isn’t complicated; it just requires you to collect the correct information.

At its most basic, your operating costs formula looks like this:

Operating Costs = COGS (Food + Beverage) + Labor + Overhead + Marketing + Tech + Other Recurring Expenses

To calculate your total operating costs, add up everything you spend on COGS (food + alcohol + beverages), labor, overhead (rent, utilities, insurance, etc.), marketing, technology, and any other recurring expenses during a specific period—typically monthly.

Once you total those expenses, the result is your operating costs.

Here’s a quick example:

Let’s say your restaurant generated $120,000 in monthly revenue and your monthly spending looked like this:

- $36,000 on food and beverage purchases

- $42,000 on labor (including payroll tax and benefits)

- $18,000 in overhead (rent, utilities, waste removal, insurance, maintenance)

- $6,000 in technology and software

- $3,000 in marketing

- $3,000 in other recurring expenses

Your total operating costs would be:

$36,000 + $42,000 + $18,000 + $6,000 + $3,000 + $3,000 = $108,000

In this case, operating costs consume 90% of revenue. The average operating cost for most restaurants is 85%, which doesn’t leave much room for profits, so it’s easy to see why staying on top of operating costs is critical for success.

Breaking it down this way makes it easier to see which buckets are driving costs up and where improvements could have the biggest impact.

It also helps to understand how different expenses behave.

Fixed Costs vs. Variable Costs: Why it Matters

Most of your restaurant costs fall into one of these two categories:

- Fixed costs: These expenses stay the same month after month, no matter how busy or slow you are (rent, insurance, waste removal contracts, etc.).

- Variable costs: These rise and fall depending on sales volume (food purchasing, hourly labor, packaging).

Understanding the difference matters because fixed costs are largely outside of your control, while variable costs are where you can take action.

For example, you can’t renegotiate your lease every month, but you can reduce food waste, adjust purchasing based on demand, or tighten up labor scheduling to protect your margins.

You don’t need sophisticated software to track this—a simple spreadsheet will work. The key is consistency.

The more regularly you monitor your spending, the easier it becomes to spot inefficiencies early, plan budgets with confidence, and make decisions proactively instead of reactively.

How To Evaluate Costs Against Revenue and Profitability

Tracking operating costs is only useful if you compare them to the money coming in.

Operators who evaluate costs against revenue can see whether their business is becoming more (or less) efficient, regardless of how much revenue they bring in. That’s because raw dollar amounts don’t tell the full story.

For example, a $30,000 food cost sounds high on paper… until you learn that the restaurant brought in $150,000 that month. That makes their food cost percentage 20%, an average that any restaurant would envy.

By looking at operating costs as a percentage of revenue, you get a clear picture of how much of every dollar earned is being spent. That’s the foundation of profitability.

Why Percentages Matter More Than Raw Numbers

Strictly using dollar amounts can be misleading, which is why you should use percentages to reveal how efficiently your restaurant is running.

Percentages allow you to compare different months or locations, even if your sales volume changes.

When you evaluate costs this way, you can spot trends quickly. For example:

- If sales go up but your operating costs rise faster, you’re making less profit, not more

- If sales drip but you’re able to reduce variable costs, you can maintain healthy margins

Tracking your finances with percentages answers the real question every operator should be asking:

“How much of every dollar we earn are we keeping?”

This approach makes performance comparisons simple and keeps you focused on profitability, not just what you’re spending.

What Percentage of Revenue Should Go Toward Operating Costs?

As we discussed, the average restaurant spends about 85% of their revenue on operating costs.

That covers everything: food and beverage purchases, labor, rent, utilities, marketing, tech—the whole list. That means you’re left with 15% or less for profit.

The higher your operating costs climb as a percentage of revenue, the harder it becomes to make money. It’s not uncommon for restaurants to generate strong sales but still struggle financially because their costs are too high relative to revenue.

Use Prime Cost as Your Financial North Star

While total operating cost percentages are valuable to monitor, prime cost should be the metric that guides your financial decisions. Prime cost combines your two biggest controllable expenses.

The formula looks like this:

Prime Cost = COGS + Labor Costs

The average prime cost for most restaurants is 60%-65%, and unlike fixed expenses such as rent or insurance, these are costs you can actively influence.

When you monitor your prime costs weekly, or even daily, you can make quick adjustments to purchasing, portioning, labor scheduling, and prep before small issues turn into expensive problems.

Putting prime cost at the center of your decision-making gives you a reliable indicator of whether your restaurant is headed toward profitability or drifting off course.

When prime cost is under control, the rest of your business becomes significantly easier to manage.

Use Cost Percentages to Plan Your Menu Pricing and Margin Strategy

Now that you understand why you should monitor cost percentages and not raw dollar amounts, it’s time to tie them directly into your pricing strategy and margins.

For example, if your target food cost percentage is 30% and a dish costs you $4.50 to make, you now know to price your dish at a minimum of $15.

Too many operators set menu prices on gut instinct, or worse, based on what their competitors are charging. This approach can get you in a lot of trouble and is easily avoidable if cost data is used correctly.

Understanding your percentage goals allows you to:

- Identify low-margin menu items and reprice or remove them

- Spotlight high-margin dishes and promote them more effectively

- Adjust labor based on projected demand instead of speculation

Tracking cost percentages turns your spending into strategy. It helps you make pricing decisions confidently and protect your margins—no guessing, no surprises.

Strategies To Control and Reduce Operating Costs Without Sacrificing Quality

Reducing operating costs doesn’t have to mean cutting corners, buying lower-quality ingredients, or putting extra pressure on staff. The strongest operators focus on increasing efficiency and getting more value out of the money they’re already spending.

Below are practical strategies to help reduce waste, improve operations, and get more value out of every dollar you spend.

Improve Food Cost Control Through Portioning, Inventory Tracking, and Weekly Product Audits

Food costs don’t explode overnight—they creep. A few extra ounces on every plate, a forgotten case of produce in the walk-in, and suddenly your profit margin is gone.

A simple system solves this:

- Use portioning tools like scales, ounce-specific ladles, and jiggers behind the bar to ensure every dish matches its recipe

- Reviewing vendor invoices helps you catch price jumps immediately

- Weekly inventory prevents over-ordering and highlights waste trends

For example, if your spreadsheet shows that you should have 12 pounds of chicken left, but the kitchen reports six, you now have a clear signal: either portioning is off or product is walking out the back door.

Having visibility into your food usage gives you control. It’s not about micromanaging—it’s about protecting your margins.

Reduce Labor Inefficiencies With Smarter Scheduling and Cross-Training

Labor inefficiency rarely looks dramatic. It shows up as someone clocking in 15 minutes early every shift or two employees closing when only one is needed. Individually, these moments don’t feel expensive. But over a month or a quarter, they add up to thousands of dollars.

Scheduling based on projected sales, instead of copy/pasting the schedule every week, keeps labor aligned with revenue.

Cross-training helps, too. When your team can switch between roles, you can maintain coverage during slow periods without adding unnecessary labor hours.

The result is a leaner, more efficient labor model that protects both payroll and service quality.

Focus Your Marketing on Customer Retention Instead of Constant Acquisition

Some restaurants overspend on paid ads designed to attract new customers while ignoring the gold mine they already have: repeat customers.

It costs far less to get an existing customer to order again than to convince a new one to try you for the first time.

Instead of spending on broad advertising, use digital tools that encourage repeat visits and nurture customer relationships, like:

- Loyalty programs

- Email marketing campaigns

- Clear “order direct” messaging across your online channels

These efforts build predictable revenue without additional ad spend.

Use Technology to Reduce Waste and Eliminate Manual Tasks

Yes, technical tools do cost money up front, but the long-term savings in time, accuracy, and labor easily outweigh the expense.

Incorporate high-ROI tech tools that automate repetitive tasks, like:

- POS systems that integrate with inventory and online ordering

- Scheduling software to forecast labor needs and prevent overstaffing

- Payroll tools to automate tax compliance and reduce admin time

- Online ordering platforms that drive repeat business

If a tool saves you 10 hours of labor every week or helps you retain more loyal customers, don’t look at it as a cost, but rather an investment in growth and efficiency.

The Path to Profitability Starts With Knowing Where Your Money Goes

When you understand your numbers and make decisions based on real cost data, profitability stops feeling unpredictable. The restaurants that take control of their costs take control of their future, and that’s where confidence and growth begin.

Contact ChowNow to learn how a branded Restaurant Website and Direct Online Ordering system can help you increase direct orders, and build a more profitable, sustainable restaurant business.

Restaurant Operating Costs Frequently Asked Questions

What are the main operating costs of a restaurant?

Operating costs are the ongoing expenses required to keep a restaurant running day to day. This includes food and beverage purchases (COGS), labor (wages, taxes, benefits), rent or mortgage, utilities, insurance, technology subscriptions, marketing, cleaning services, and other recurring expenses. If it’s an expense you pay consistently to stay open, it’s an operating cost.

What percentage of a restaurant’s revenue should go to operating costs?

Most restaurants spend around 85% of their revenue on operating costs. That leaves about 15% for profit, taxes, and reinvestment. If operating costs grow faster than revenue, profitability shrinks—even if sales increase.

How can I reduce food and beverage costs without lowering quality?

You can reduce food and beverage costs by controlling waste, standardizing portion sizes, improving inventory tracking, and auditing product usage weekly. Many operators find savings by simplifying the menu, negotiating better pricing with suppliers, or cross-utilizing ingredients across multiple dishes. The goal isn’t to cheapen the food, it’s to eliminate waste and make better use of what’s already available.

Are labor costs part of operating expenses?

Yes. Labor costs, including wages, payroll taxes, benefits, and training, are a major part of operating expenses. Labor is also one of the most controllable costs, which is why scheduling based on demand and cross-training staff can have a meaningful impact on profitability.

What’s the difference between operating costs and prime costs?

Operating costs include everything required to run your restaurant: COGS (cost of goods sold), labor, overhead, marketing, technology, and other recurring expenses.

Prime cost is a more focused number: COGS plus labor. Prime cost is considered the most important number to monitor because it’s the collection of all of your most controllable expenses, meaning you can influence and adjust how they affect your margins through pricing, portioning, and scheduling.