Chargeback Frauds: What Operators Need to Know

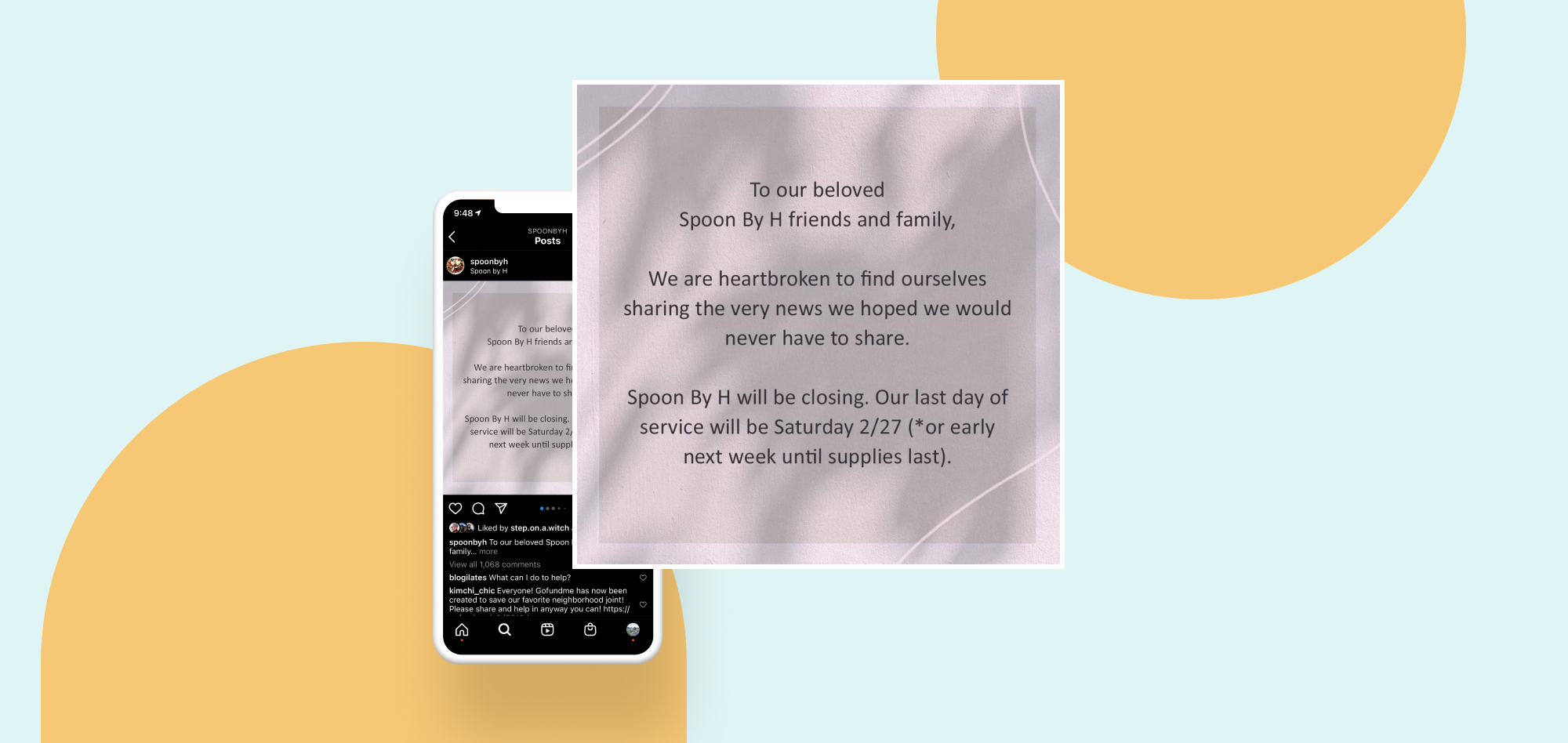

The recent closure of a popular Los Angeles restaurant, Spoon by H, surprised many of its loyal patrons. It’s always sad to see a restaurant shut its doors, and so many have had to call it quits due to the endless challenges of the COVID-19 pandemic. But what shocked customers was the specific reason that Yoonjin Hwang, the chef of Spoon by H, gave for the closure: credit card chargebacks and the chargeback frauds perpetrating the acts.

If you’ve taken payments by credit card, you’re probably familiar with chargebacks—reversals of credit card payment due to a disputed credit card transaction.

In Hwang’s case, her restaurant experienced a “growing barrage” of these disputes. In an Instagram post, she wrote, “We spent hours upon hours fighting each claim and refund, until eventually they buried us. It was an unending, uphill battle every day that robbed us of time, energy, and resources we just couldn’t afford. These cases became unbelievably frequent and they’ve somehow become so increasingly routine that it has made it impossible to continue to operate a business under these conditions.”

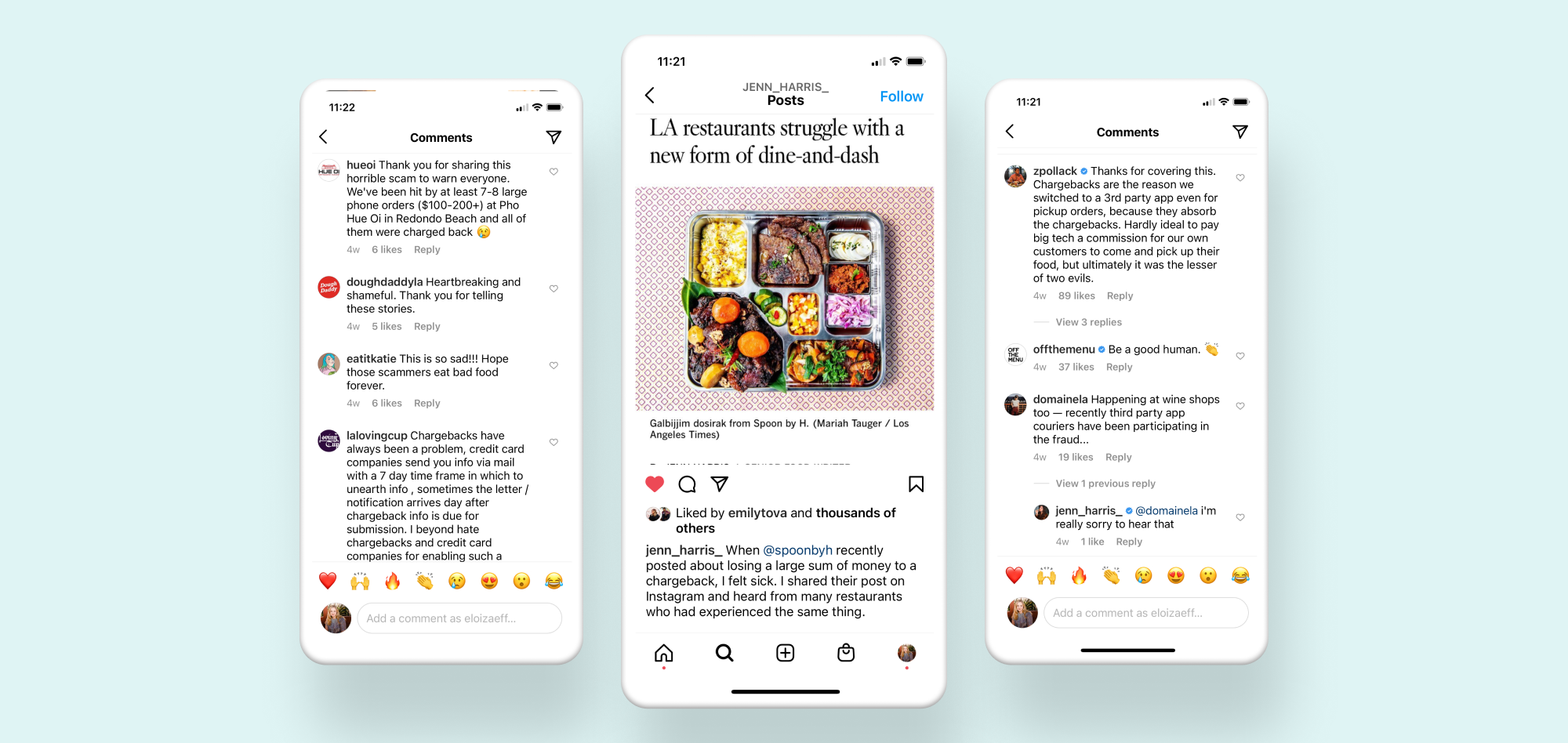

While Hwang’s saga may sound extreme, many other restaurants have also experienced an uptick in chargebacks over the past 12 months.

The Changing State of Credit Card Fraud and Chargebacks for Restaurants

Online orders for food and beverage grew an incredible 93 percent between 2019 and 2020. These transactions are associated with a greater degree of risk when it comes to chargebacks and fraud.

Thankfully, fraud in the form of data breaches, identity theft, account takeover, and loyalty program abuse actually seems to be on the decline. Forter notes that instances of fraud in food and beverage dropped by 55%, relative to overall sales.

Unfortunately, though, service-related chargebacks are more and more common. These types of chargebacks usually reflect customer dissatisfaction. However, the economy in general has also seen an increase in another kind of service chargebacks: Those motivated by fraudulent contactless delivery and buy-online-pickup-in-store schemes. The media has started to call these problems in the restaurant industry “digital dine and dash.”

Some of these instances can be prevented by encouraging clear and open communication with customers. As a safety net, operators may also take photos of their orders or require customers to show their IDs when picking up food. But when restaurants need to offer off-premise service and are continually pressed for time and resources, what else can you do?

Really, the key is having a good partner. Different online ordering platforms have varying policies when it comes to credit card fraud and chargebacks. While many of them leave restaurants on the hook, ChowNow and several other providers work on behalf of their restaurant partners to keep the money in their pockets.

Here’s an overview of various platforms’ chargeback policies for restaurants.

What’s Grubhub’s credit card chargeback policy for restaurants?

Grubhub doesn’t publicly share much about its chargeback policy for restaurants, but a client named Barb Leung has offered some insight. A staffer at Nom Wah, a dim sum parlor with locations in New York City and Philadelphia, Leung described a frustrating experience with Grubhub’s credit card chargeback policy. The online ordering platform gave her just 24 hours to file a dispute to a $641 chargeback.

Thankfully, she was able to push against it. Grubhub now offers restaurants seven days to identify errors in chargebacks. Still, the onus is on her and other independent restaurateurs to spot these claims and fight them.

In its help center, Gruhub notes that they may refund a diner on your restaurant’s behalf in certain cases, including:

- Missing or incorrect items

- Entirely incorrect orders

- Not responding to Grubhub’s attempts at contacting your restaurant

- Food quality, temperature, or damage

- Food poisoning or allergies

What’s Uber Eats’ credit card fraud and chargeback policy for restaurants?

Uber Eats will “refund customers on your behalf and make adjustments from your pay” in certain scenarios along the same lines as Grubhub’s. These include issues with missing items, incorrect items, and incorrect orders.

In its help center, Uber Eats also states: “We take fraudulent behavior seriously and have filters in place to monitor user behavior–we will not make adjustments on suspicious refunds.”

If you have an issue with any adjustments, your restaurant has 30 days to dispute it.

What’s Doordash’s credit card fraud and chargeback policy for restaurants?

Doordash usually refunds customers on your behalf for missing or incorrect items. According to their help center, you have 10 days to dispute any of these refunds.

In a statement made to Today, a Doordash spokesperson commented that “depending on the issue,” the company will pay for refund credits. In these cases, they won’t pass the cost onto your restaurant without “strong evidence.”

Doordash will help investigate reports of fraudulent credit card activity, and may deactivate customer accounts that misuse their credit and refund policy.

What is Postmates’ credit card chargeback policy for restaurants?

Like many of the other big delivery apps, Postmates refunds customers on your restaurant’s behalf for issues like incorrect or missing items. You have a 14 day window to dispute any of these adjustments.

Outside of the most popular marketplace delivery apps, software providers’ credit card chargeback policies differ a bit more.

What is Toast’s credit card chargeback policy?

Toast charges you $15 whenever a chargeback is filed. They will alert you of the chargeback and provide some guidance, but won’t communicate to the credit card company on your behalf. They also require you to submit your dispute evidence via fax, rather than through email.

What is MenuDrive’s credit card chargeback policy?

If you use MenuDrive Pay, you are charged a fee whenever a customer files a chargeback. You have to provide evidence within seven to 21 days—depending on the credit card company’s policy—and proactively contact MenuDrive’s support team.

What is GloriaFood’s credit card chargeback policy?

GloriaFood only enables a connection between your restaurant’s account and your credit card payment processor. This means that GloriaFood doesn’t actually handle payments on your behalf, so they can’t assist with chargeback disputes or provide any insurance.

Read More: The Truth About Free Online Ordering Systems for Restaurants

What is Tock’s credit card chargeback policy?

According to their help center, Tock notifies your restaurant when a chargeback happens. They help provide some evidence on their end, but they also ask you to gather and submit evidence of your dispute.

What is BentoBox’s credit card chargeback policy?

BentoBox defers fraud and chargeback disputes to Square or Stripe, depending on which credit card processor your restaurant uses. Both Square and Stripe will alert restaurants when a chargeback happens, but they have different processes.

- Square manages disputes on your restaurant’s behalf and requires evidence of your dispute. If the chargeback is successfully reversed, they’ll refund their payment processing fee.

- Stripe won’t manage disputes on your behalf, and also requires evidence. They’ll charge your restaurant $15 whenever a chargeback occurs, and won’t refund the payment processing fee if the chargeback is reversed.

What’s ChowNow’s fraud and chargeback policy?

ChowNow foots the bill for chargebacks – no questions asked. Your restaurant doesn’t lose any sales. and you don’t need to worry about fighting credit card companies. The finance team at ChowNow uses advanced fraud detection methods to reduce risk across the board, and takes care of everything on your behalf.

We’re not just a safety net—ChowNow offers all the tools modern restaurants need to grow their online businesses, including commission-free website ordering, branded mobile apps, digital marketing, and much more. Learn more by scheduling a free demo today.