How to Conduct a Breakeven Analysis for Your Restaurant: A Step-by-Step Guide

As a restaurant owner, understanding your financial health is critical to long-term success. One essential tool for assessing your restaurant’s financial performance is the break-even analysis. This analysis helps you determine the point at which your restaurant starts to make a profit—where your total revenue equals your total costs.

By conducting a break-even analysis, you can make informed decisions about pricing, cost management, and overall strategy. In this post, we’ll walk through the process step by step, with examples to make it tangible and actionable.

What Is a Break-even Analysis?

A break-even analysis is a calculation that helps you determine the number of units (in this case, meals or dishes) you need to sell to cover all your costs. It’s a crucial metric for understanding your restaurant’s profitability and informed decision-making.

For new restaurants, this analysis is helpful for gaining investor support and setting a timeline of when they can expect a return on their investment. It demonstrates that you understand your business’s financials and have a clear path to profitability.

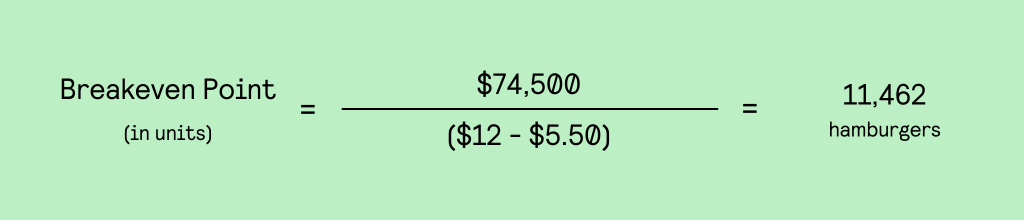

The formula for break-even analysis is:

- Fixed Costs: These are expenses that generally don’t change, regardless of how much you sell. Examples include rent, salaries, insurance, and equipment leases.

- Variable Costs: These are costs that vary directly with sales volume, such as ingredients, labor wage, and utilities.

- Selling Price per Unit: This is the average price at which you sell your dishes.

How to Calculate Your Break Even Point

Step 1: List All Your Fixed Costs

Start by listing all your fixed costs. These are the expenses that remain constant regardless of how much business you do. Common fixed costs for your restaurant may include:

- Rent or mortgage payments: $10,000/month

- Labor wages: $60,000/month

- Insurance: $2,000/month

- Equipment lease: $2,000/month

- Utilities (a portion that is fixed): $500/month

Example: Let’s say your total fixed costs are $74,500 per month.

Step 2: Determine Your Variable Costs per Unit

Next, calculate the variable cost per unit—what it costs you to produce each dish. Consider the cost of ingredients, hourly wages for kitchen staff, and any other costs that vary with production.

Example: If you run a burger restaurant, the variable costs might include:

- Ingredients (bun, patty, toppings): $3 per burger

- Hourly wages for staff per burger (estimated): $2

- Utilities (variable portion per burger): $0.50

In this example, the total variable cost per burger is $5.50.

Step 3: Set Your Selling Price per Unit

Determine the average price at which you sell your dishes. For this example, let’s assume you sell each burger for $12.

Step 4: Calculate the Break-even Point

Now, you can calculate the break-even point using the formula provided earlier.

This means you need to sell approximately 11,462 burgers per month to cover your fixed and variable costs.

Note: The costs presented in this article are estimates only and can vary based on specific circumstances like location, restaurant size, and equipment needs.

Step 5: Analyze and Adjust Your Inputs

With the break-even point calculated, you now have a critical piece of data to guide your decisions. If you think selling 11,462 burgers per month is achievable based on your current customer traffic, you’re on track. However, if this number seems too high, consider the following adjustments:

Increase the Selling Price: Can you raise prices without losing customers? Even a small increase can lower your break-even point. If you raise the price of your burger to $14, the break-even point becomes 8,765

Reduce Variable Costs: Look for ways to reduce the cost of ingredients without compromising quality, or find efficiencies in labor by exploring opportunities for automation. If you reduce your variable cost per burger to $5, the break-even point becomes 10,643.

Lower Fixed Costs: This is often more challenging, but you could negotiate a lower rent, lower labor costs, or find ways to save on utilities.

Break-even analysis isn’t just a one-time exercise. Use it whenever you’re planning to make significant changes, like introducing a new menu item, expanding your restaurant, or adjusting prices. Regularly revisiting your break-even point can help you stay on top of your financial health and make data-driven decisions.

Explore more resources to set your restaurant up for financial success: